It Is Crucial to Have a Deep Understanding of the Distinctions Between LEI Policies

Knowing the Difference Between Legal Expense Insurance Policies Helps Your Clients and Mitigates Your E&O Risks

As insurance brokers, it is essential that we stay informed and knowledgeable about the various insurance products available in the market. When it comes to legal expense insurance (LEI), understanding the differences between policies is crucial. Not only does this enable you to better serve your clients, but it also helps mitigate errors and omissions (E&O) risks. In this blog post, we will explore why you need to know the distinctions between LEI policies and how this knowledge can protect both your clients and their business.

As insurance brokers, we have a responsibility to provide tailored solutions that meet the unique needs of our clients. By familiarizing yourself with the intricacies of different LEI policies, you can accurately assess which policy best aligns with each client's specific requirements. This client-centric approach demonstrates your commitment to offering comprehensive coverage and minimizes the potential for errors and omissions.

LEI policies can differ significantly in terms of coverage limits, deductibles, exclusions, and claim procedures. By understanding the differences between them, you can effectively identify potential coverage gaps and ensure that your clients' legal protection needs are adequately met. Clear explanations of policy terms, conditions, and exclusions will enable your clients to make informed decisions, reducing the likelihood of misunderstandings and potential E&O claims.

Benefits of Recommending ARAG’s Legal Expense Insurance:

Enhanced Client Protection: By recommending ARAG’s LEI, you can provide your clients with an additional layer of protection against unexpected legal disputes. This proactive approach demonstrates your commitment to their welfare and strengthens your relationship as a trusted advisor.

Financial Security: Legal disputes can be financially draining, and your clients may find themselves unable to afford the high costs associated with litigation. ARAG’s LEI ensures that your clients have access to legal representation, allowing them to defend their rights and interests without straining their financial resources.

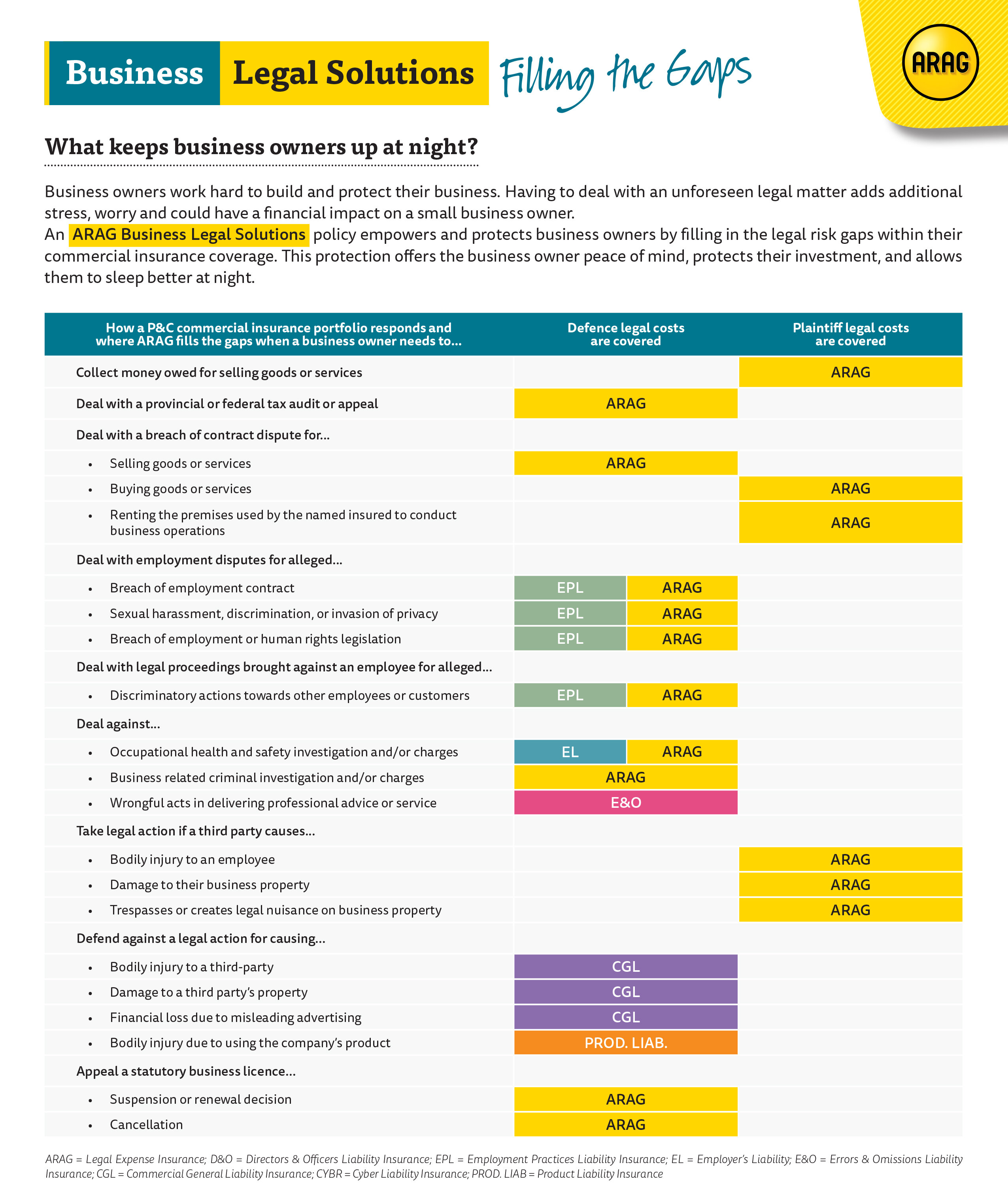

Risk Mitigation: By actively promoting LEI, you can mitigate your own E&O risk exposure. First, there are legal risk gaps that policies within a typical commercial portfolio will not cover, such as debt collection, contract disputes, auto legal defence and tax protection. Second, by encouraging clients to secure appropriate legal coverage, you reduce the likelihood of potential claims resulting from inadequate advice or insufficient coverage.

Competitive Advantage: Recommending ARAG’s LEI sets you apart from other insurance brokers in the market. It positions you as a comprehensive risk management partner who understands the diverse needs of your clients and is committed to their long-term protection. This knowledge instills confidence in your clients, assuring them that they are receiving the best possible advice and protection.

In conclusion, as insurance brokers, it is crucial to have a deep understanding of the distinctions between legal expense insurance (LEI) policies. By familiarizing ourselves with the intricacies of different policies, we can better serve our clients and mitigate errors and omissions risks. Knowing the variations in coverage limits, deductibles, exclusions, and claim procedures allows us to identify potential gaps and ensure our clients' legal protection needs are adequately met.

Recommending ARAG's LEI gives us a competitive advantage in the market. It showcases our understanding of our clients' diverse needs and our commitment to their long-term protection. This knowledge instills confidence in our clients, assuring them that they are receiving the best advice and protection available.

By staying informed and knowledgeable about LEI policies, we can provide tailored solutions, minimize risks, and deliver exceptional service to our clients. So, let's continue to prioritize our understanding of LEI and its nuances, ensuring that we remain valuable resources for our clients' insurance needs.